Honestly speaking, I had a lot of debts when I was a university student. At that time I got a scholarship that I had to pay back. I didn’t know that was a bad choice.

After I graduated from school, I had a lot of credit card debts and almost no savings.

If I could go back to those times, I would like to recommend this book to myself.

If I read this book when I was a university student, I didn’t have debts and got some savings.

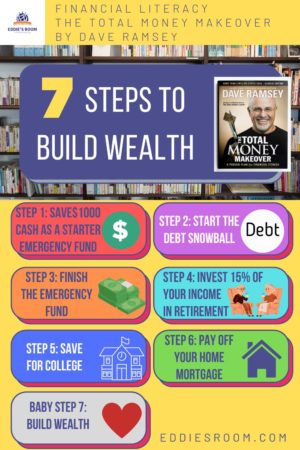

There are 7 steps to build wealth.

So we can learn the process step by step.

Baby step 1: Save$1000 cash as a starter emergency fund

Baby step 2: Start the Debt Snowball

Baby step 3: Finish the emergency fund

Baby step 4: Invest 15% of Your income in retirement

Baby step 5: Save for college

Baby step 6: Pay off your home mortgage

Baby step 7: Build wealth

And my favorite part is myth vs truth.

There are a total of 37 Myth vs Truth. (If I’m correct)

Here are my Top3.

Debt is not a tool

Myth: Debt is a tool and should be used to create prosperity.

Truth: Debt adds considerable risk, most often doesn’t bring prosperity, and isn’t used by wealthy people nearly as much as we are led to believe.

Lease is expensive

Myth: Leasing a car is what sophisticated people do. You should lease things that go down in value and take the tax advantage.

Truth: Consumer advocates, noted experts, and a good calculator will confirm that the car lease is the most expensive way to operate a vehicle.

A credit card doesn’t build your credit

Myth: You should get a credit card to build your credit.

Truth: You won’t use credit with your total money makeover, except maybe for a mortgage, and you don’t need a credit card for that.

I believe we can get much financial knowledge and related words.

This is the author page links. Please click here to check this book.