Textbook of money

I think this is a great book to learn basic knowledge about money. Especially I would like to recommend this book to high school students and university students who will start their careers.

I wanted to read this book when I was a student.

What we can learn?

Financial planning

Careers

Business and Entrepreneurship

Saving and Banking

Budgeting and Spending

Credit and Debt

Bankruptcy

Investments

Avoiding Financial Scams

Insurance

Taxes

Government benefits

Legal Issues

Growing Older

I believe all items are really important but pick up some to share here.

1. Financial planning

Experts

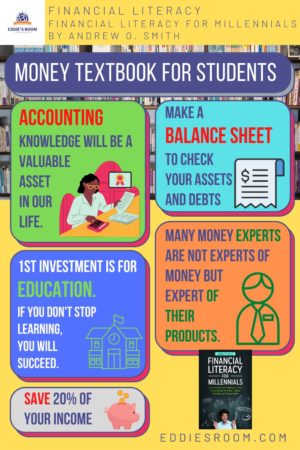

How to deal with money experts is important. We have to remember that many money experts such as financial planners or investment advisors work for a salary from a particular financial institution or insurance company.

If you take the advice of an expert who is connected to a specific company, you may not be able to choose what you need because they recommend what they want to sell. They are experts in selling their products or service but might not be real experts in money.

Keep track

It is a good suggestion to make a balance sheet of our money to check our assets and debts regularly. Oh, I’ve never done this but will do it.

2. Careers

Human capital

If we want to get useful human capital, our first investment is for education and training. Career education and training do not end there once we get a job, and we must continue as long as we work. Those who haven’t stopped learning are usually able to make successful careers.

I completely agree with the message and that’s the vision of Eddie’s room for lifelong learning.

3. Business and Entreprenouship

The language of business

The most important thing is basic accounting knowledge. Accounting knowledge will be a valuable asset throughout our life. I’m also learning it.

4. Saving and Banking

How to save

It’s very simple.

When you get the money, move 20% of the money to a savings account that you can not use easily.

The richest man in Babylon says 10% instead of 20%.

Dave Ramsey says to invest 15%of your income in retirement.

The point is not % but move some % of our income to somewhere else we can’t use it easily.

5. Budgeting and spending

College

It is surprising that the incomes of college graduates are 2 times higher than non-university graduates. And in terms of lifetime income, college graduates earn more than $ 500,000.

The Rising Cost of Not Going to College

Thank you for reading this post.

There are more useful things.

Please check the author’s website.