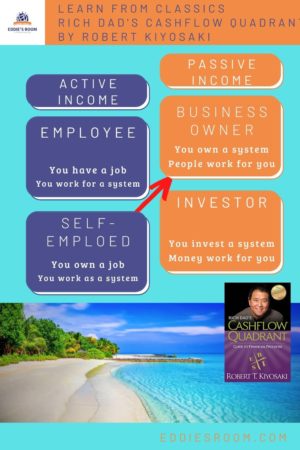

What is the cash flow quadrant?

It is interesting that the author categorized all people into four quadrants as follows.

E: Employee

Stability is more important than money for employees.

They work for the system.

S: Self-employed

Being independent is more important than money for self-employed people.

They work as the system.

They are perfectionists and want to do it themselves without leaving it to others.

B: Business owner

They own a system and have the ability to take leadership on top of others.

They make the system and have it and control it.

I: Investor

They invest money in the system.

What is the difference between “Employee” & “Self-employed” and “Business owner” & “Investor”?

The main difference is if we can get some money when we don’t work.

Needless to say, “Employee” and “Self-employed” can’t get any money when they are not working. However, “Business owner” and “Investor” get some money even if they don’t work.

And another critical difference that we need to understand is “Business owner” and “Investor” have tax benefits.

The average rich gets 70 percent of his income from the quadrant on the right and the remaining 30 percent from the left. This indicates we have to consider getting income from the “B” or “I” quadrant when we want to get financial freedom.

Importance to understand Asset and Liabilities

We learn

Assets put money in our pocket.

Liabilities take money from our pocket.

Our liabilities are someone’s assets.

Deposits are our assets because your bank is paying us interest. Even if the interest rate is very small…

And our home is not our asset but the bank’s asset if we pay interest to the bank. You know which interest is bigger…

Every time we take liabilities, it is the same thing that we’re an employee working for someone who lends us money. So Taking a 30-year loan is the same as becoming an employee with a 30-year contract!

When we need to have big liabilities, we have to find someone else pays for you.

We need correct advice and how to make decisions.

Wrong advice on money is dangerous. Most of the wrong advice is passed from parent to child at home

The author wrote, regarding money, most people are lazy or look for quick shortcuts. The important thing is to screen the facts and opinions and learn how to make decisions based on the remaining facts.

We have to learn a skill and personality

For living in each quadrant we need to learn different skills and personalities. The author listens to two learning tapes every week and participates in seminars on “B” & “I” at least twice a year.

And also the author recommends checking personal financial statements such as the balance sheet and the income statement.

Thank you for reading this post.

Do you make your financial statements? Why not?

I didn’t do that but I will dot that.